Thoughts of the Week

Writing this newsletter on Valentine’s day I can’t help thinking of romance. Maybe the huge Superbowl sign “The only thing stronger than hate is love” in an event which made President Trump furious, has also played a role. Leaving roses and chocolates aside, the focus today is the romance between AI and mankind, which started back in 2024 when OpenAI shocked the world with its new offering. As with all relationships, some people entered it with caution, while many dismissed it bluntly on their first date. Others plunged themselves in it without blinking, enjoying every second of the new experience. Two years later, it is common belief that the AI technology offers the potential to immensely enhance people’s personal and professional lives, a real beauty in other words.

But the last two weeks something seems to have changed. First, Anthropic revealed its capabilities to automatically write software for various services/workflow sectors (legal, consulting etc.) and the world realized that software companies face existential threats, while millions of software engineers will be unemployed. Then last week, it was the turn of financial companies (brokers, tax advisors etc.) which sold off, as the market very quickly looked around for the next potential victims of AI. No surprise, this coincided with the release of a new AI-enabled tax planning software, by the start-up company Altruist. News came out from an … ex-karaoke company called Singing Machine Co (now called Algorhythm Holdings) that its AI platform can scale freight volumes by 400% without the need to increase headcount and trucking/logistics companies collapse !

Is AI turning into a beast ? For those who had already started having such thoughts, they were dealt a final blow by a viral post titled “Something Big is Happening ” by Matt Schumer, an AI entrepreneur. (you can read it here: https://shumer.dev/something-big-is-happening). The situation got even worse as Anthropic CEO said in a Financial Times interview, that most while-collar jobs which are computer related could be automated within the next 12-18 months. The concept of traditional business models getting thrown into the bin across a wide spectrum of economic sectors caused panic and the prospects of a “Brave New World” (for those who have read Aldous Huxley book) is becoming a nightmare.

At this critical juncture, it is best to be calm and optimistic. Preparing for an apocalypse that might not come any time soon is not a wise investment choice. The aspirations of these start-ups to disrupt our lives by releasing the beast, appear to be a huge exaggeration, perhaps much like the Chinese DeepSeek announcements, last February (by coincidence) that their cheap version of AI will cause the collapse of US based platforms. The subsequent tumble of Nasdaq proved to be only temporary and nothing in AI development has really changed since. We choose to be optimistic that if governments and the mega Tech companies wish to establish AI as a beloved tool that will enhance our tasks , increase productivity and lead to (much needed) new avenues in healthcare and other crucial sectors , they will take the necessary measures to put the beast back in its cage. If they don’t, then they will be accountable for unemployment to spike to 10% or 20%, massive defaults on mortgages, corporate and consumer loans will crash banks and the largest economies in the world will simply collapse. Now is the time for proactive action and control.

Weekly highlights

US inflation increased less than expectations in January. The headline CPI was up 0.17% with the 12-month change falling from 2.7% to 2.4%. Meanwhile the core CPI increased 0.30%, with the 12-month slipping from 2.6% in December to 2.50% in January. Nonetheless the 30bp core CPI monthly increase constitutes one of the stronger increases in the past year. Overall, there have been issues with sampling, the government shutdown, and other factors that are leading to increased volatility of the monthly inflation data, and as we had mentioned last month, there is a downward bias for the months of January to March, given the lack of data due to the government shutdown.

The US labor market data continue to feed our suspicion for lack of reliability. The January non-farm payrolls were published at +113k, much better than expected, in contrast with last week’s weak labor market data from other sources. It is worth noting that revisions during 2024 and 2025 have been massive, unlike the previous years, which points to our lack of conviction when we see the first release of the data. During the 1st half of 2025 (Jan-June), it appeared that the US economy was generating 985k jobs, only to see those months revised down to a total of just 162k. In the second half of the year initial payroll growth of 223k was revised down to just 19k. As a result, revised total payroll growth in 2025 (181k) was the lowest since 2003, not counting recession years.

December US Retail Sales were on the weak side. In a month that includes the holiday season, Retail Sales were flat vs expectations for +0.4%, while the control group (which feeds into the GDP calculation) was -0.1% vs expectations for +0.4%.

US credit card delinquencies rose to the 2009 financial crisis high. According to the NY FED Q4 credit report, overdue payments by more than 90 days have risen to13% of the outstanding, just below the 14% rate achieved at the height of the global financial crisis in late 2009 and into 2010. Just two years ago the same percentage was 8%. Auto loan delinquencies at 90 days past due have now surpassed the crisis highs and are just over 5%.

Markets’ reaction

Global equities’ divergence continued last week. Outflows from the US market and in particular from Technology, pushed Nasdaq down 2% for the week, and the index has now dropped for five weeks in a row, a rather rare event lately. Europe, however, moved higher and the performance differential with the US widened. The broad European indices are up between 4% and 5% this year, while the S&P500 is slightly negative and Nasdaq -3%. In terms of sectors, Energy continued to be a positive contributor on both sides of the Atlantic, while Financials were weak. In Europe, defensive sectors (food, beverage, telecoms, healthcare) were the place to be, as defense sector names were under pressure.

The bond market rallied in response to the US equity turmoil and the benign inflation. The fact that the hedge fund community is short US treasuries , positions which have to be covered, also gave fuel to the move. The 10yr US yield fell to 4.05%, while the German equivalent touched 2.75%, the lowest level since December.

Precious metals were volatile once again, and dropped for the week. Gold touched the low of 4900$ during the correction, while Platinum touched the 2’000$ mark, while Silver fell to as low as 73$. Metals and momentum/Nasdaq stocks have been very correlated lately, which shows the participation of speculators and momentum chasers in the market. As we have already said, this does not usually end well, as Silver remains about 30% off its recent peak and disillusioned retail traders could soon abandon it. Gold is the place to be in metals, as demand from institutions and investors remains strong, especially below 5000$.

The EURUSD remained above support at 1.1850. The dollar was weak for most of the week, but the labor market data and the metals’ sell-off gave it a boost and we should also keep in mind that the hedge fund community is short the currency. Still, when the EURUSD reached 1.1850, the previous strong resistance which has morphed into support, it rebounded to end the week closer to 1.1880.

Chart of the week:

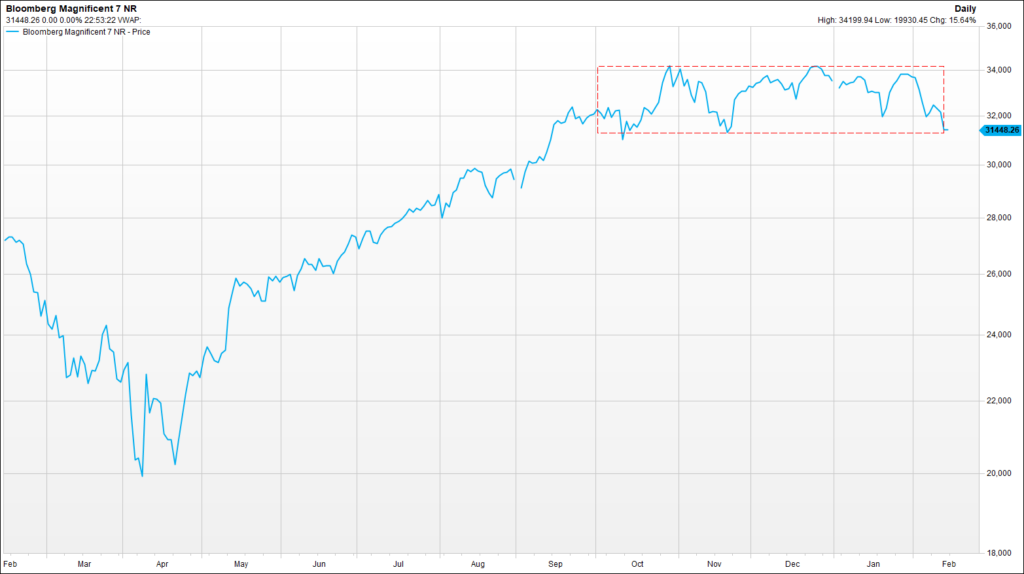

Make-or-break time for the Maginificent-7

The above chart shows the Bloomberg Magnificent-7 index for the last 12 months, or in other words the performance of an equal-weighted basket of Apple, Microsoft, Alphabet, Amazon, Tesla, Nvidia and Meta Platforms. As we can see these stocks as a basket have not moved at all since September of last year and they have entered into a , what technicians call, “box formation” (red rectangle). Being 6% down for the year, the basket has returned to the support line of this box formation which is crucial for the short-term direction. This type of consolidation can be seen under two different lenses: The bears will point to the loss of momentum and a precursor of a potential breakdown and sharp correction. The bulls will see it as a healthy consolidation phase, which makes the stocks even more attractive, as market capitalizations have remained largely unchanged but profits have been growing in the quarters that have elapsed. We would probably find ourselves in the latter camp as some of the Magnificent-7 are now trading at very attractive valuations vs their history and their recent earning reports are not a cause for alarm. However , owning all seven is probably not the best idea., which means the Nasdaq-100 ETF might not be the optimal Tech-related investment vehicle for 2026, as the above basket is about 50% of the index.

Disclaimer

- The content of this document has been produced from publicly available information as well as from internal research and rigorous efforts have been made to verify the accuracy and reasonableness of the hypotheses used. Although unlikely, omissions or errors might however happen.

- The data included in this document are based on past performances and do not constitute an indicator or a guarantee of future performances. Performances are not constant over time and can be positive or negative.

- This document is intended for informational purposes only and should not be construed as an offer or solicitation for the purchase or sale of any financial instrument and it should not be considered as investment advice. The market valuations, views, and calculations contained herein are estimates only and are subject to change without notice. Any investment decision needs to be discussed with your advisor and cannot be based only on this document.

- This document is strictly confidential and should not be distributed further without the explicit consent of Kendra Securities House SA.

- Sources : Chart: KSH/FactSet, Photo ; Warner